The smart Trick of Appliance Financing That Nobody is Talking About

Table of ContentsAppliance Financing - TruthsAppliance Financing Things To Know Before You BuyAppliance Financing Can Be Fun For EveryoneThe 6-Second Trick For Appliance FinancingThe 7-Minute Rule for Appliance Financing

In enhancement, renting out devices might cost you even more money. Typically, the loan provider doesn't check what you are using the cash for or also ask.You can acquire the home appliance during this time and after that pay it off prior to the credit scores card begins gaining interest. Financing devices can come with many benefits.

You do not need to fret about draining your financial institution account or cost savings to obtain a home appliance. Funding can provide you with a way to get the devices you need and also make the settlements back month by month. Some other advantages consist of: Develop your credit score background, Raise your credit history rating if you pay promptly, Some deal 0% rate of interest, Get a new appliance to enhance the value of your house This relies on the funding you took and also just how big it is.

The loan provider will certainly give you a layaway plan with all the funding terms set out - appliance financing. It will tell you for how long your term is for as well as exactly how lots of months or years it will take you to repay. Sometimes, you may be incentivized to pay the financing off early.

The Ultimate Guide To Appliance Financing

Most finance terms last in between 2 to 7 years for individual loans. An appliance is usually a smaller sized acquisition than various other house enhancement choices, so it might not take you long to pay off. Some loans might just be one year. Initially, examine the internet site you are intending to get the appliance from.

This could be the most hassle-free alternative. Nevertheless, do not be deceived by benefit or strong print advertising and marketing. Meticulously examine the fine print, rate of the actual device, as well as various other choices before moving forward. Purchasing online for home appliances and also financing deals can help you get ready for your visit to the store, if indeed you do really require to visit the shop.

Deluxe devices that are brand-new and also extra pricey can be tougher to certify for. If you can improve your credit score, funding devices must be a lot more expense effective and easier to certify for.

The Residence Depot Non-mortgage consumer debt Card supplies a marketing 0% rate of interest rate for 6 months on acquisitions of $299 or even more. If you wait for a seasonal promotion you might discover a longer time period for the interest cost-free financing. Realize that if you miss a payment you may be charged for the complete interest quantity.

A Biased View of Appliance Financing

Consumers have a range of choices, consisting of co-branded bank card, a Sears card, as well as residence financing. These cards function in a similar way to Lowes you make points which can be retrieved at any kind of Sears area. The Sears Home Services is for funding significant house improvement projects, where they also assist in setup and also maintenance.

There are hassle-free choices readily available to you, no matter what sort of home appliance you're seeking. If you would like to know exactly how to fund home appliances, here are your most effective choices. Many of the stores like Lowes and Costco don't have versatile funding choices various other than bank card that include benefit programs.

A personal financing or device lending can be a wise method to fund appliances, especially if you are planning on acquiring even more than one. Compared to credit report cards, individual loans usually have a lot reduced rate of interest rates.

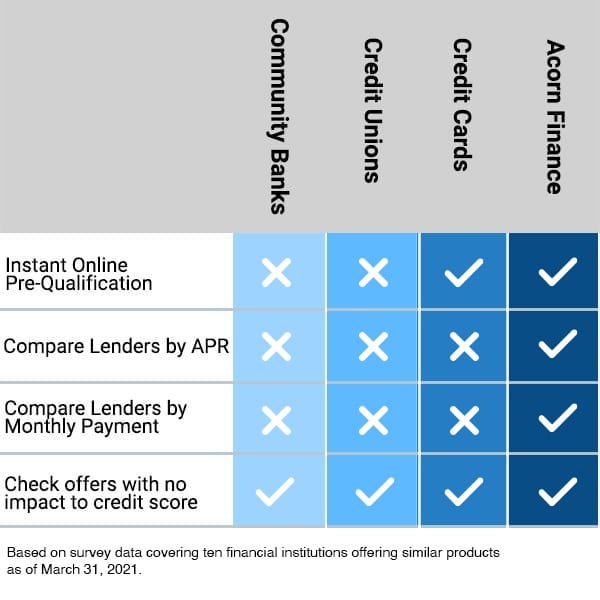

At Acorn Finance you can examine personal car loan offers within one minute or less without impacting your credit rating. If this is your ideal original site choice, make sure you go shopping around for the very best rates and also choose carefully. You intend to identify what's cost effective for you. There are property owners that want even more flexibility over their devices not just in regards to financing, yet having the ability to return them any time.

Some Known Details About Appliance Financing

Similarly you lease a house, you rent out the devices that are placed inside it. Every payment renews your lease as well as you rate to quit your settlements at any time and return the appliance. If you pay for long enough, you may end up paying for the product outright.

Home renovation isn't low-cost, but often it becomes a "need to do" rather than a "wish to." When that holds true, a bank card from Home Depot could be just the ticket, particularly for emergency situations that include a Web Site high rate tag. Home Depot supplies a range of credit scores cards, including consumer cards as well as firm cards.

The fundamental Residence Depot credit rating card provides a marketing 0% rate of interest; after that, the yearly percentage price (APR) ranges from 17. 99% to 26. 99%. House Depot likewise provides a job loan charge card, which works much more like a line of credit score, with a limited amount of time to pay back an equilibrium as high as $55,000.

The Facts About Appliance Financing Revealed

For purchases of even more than $299, House Depot supplies 0% rate of interest for 6 months and various other promos throughout the year. You can typically locate 12-month interest-free financing on home appliances of $299 or even more, 24 months of unique financing on heating and also air conditioning, as well as seasonal deals, such as $25 off snow blowers in the loss.

The 0% financing produces a fantastic heading, yet it's just free if you adhere to the rules. Like any other "deferred passion" promotion, 0% for six months indicates that you need to pay the equilibrium in full before the six months run out. If you're also someday late, Citi (the financial institution behind the Residence Depot credit cards) will charge you the full rate of interest quantity for the previous six monthsas if the promotion never existed.

If you do not have a background of continually paying your credit scores card balances completely at the end of the month, it's best to steer clear of promotional offers like these. Note that shop credit rating cards are "private label" and are unlike general usage credit history cards navigate here that have a Master, Card or Visa logostore cards can just be made use of at the retailer, whereas basic usage cards can be made use of at any kind of vendor that accepts them.